SMM Alumina Morning Comment 3.28

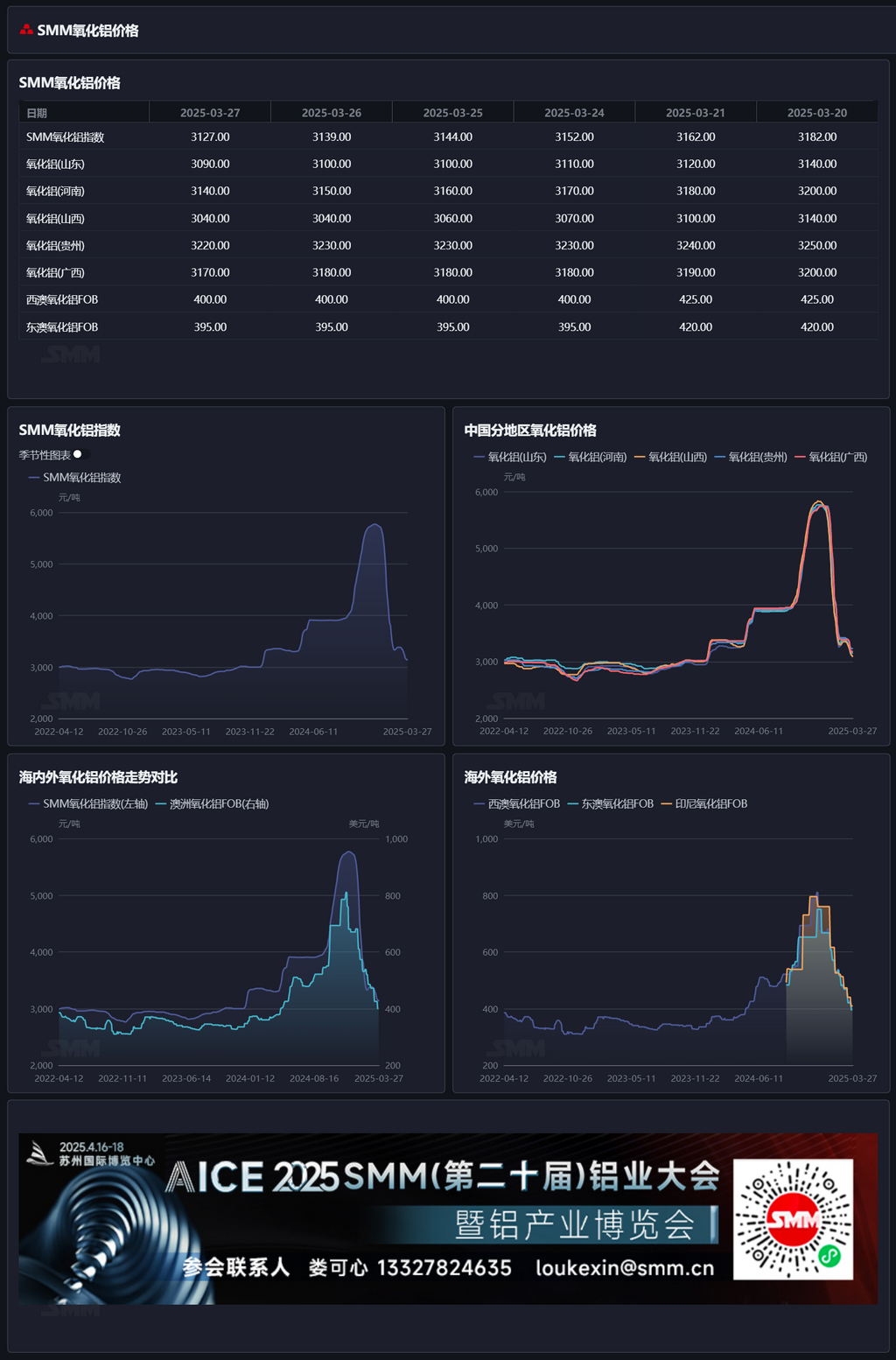

Futures market: In the night session, the most-traded alumina 2505 contract opened at 3,050 yuan/mt, with a high of 3,066 yuan/mt, a low of 3,036 yuan/mt, and closed at 3,049 yuan/mt, down 13 yuan/mt, or 0.42%, with an open interest of 208,000 lots.

Ore side: As of March 27, the SMM imported bauxite index stood at $93.16/mt, flat from the previous trading day; the SMM Guinea bauxite CIF average price was $91/mt, flat from the previous trading day; the SMM Australia low-temperature bauxite CIF average price was $87/mt, flat from the previous trading day; the SMM Australia high-temperature bauxite CIF average price was $81/mt, flat from the previous trading day.

Spot alumina market: On Thursday, 5,000 mt of spot alumina was traded in Shanxi at a transaction price of 3,050 yuan/mt.

Industry dynamics:

- Port alumina inventory: According to SMM statistics on March 27, domestic port alumina inventory totaled 28,000 mt, down 20,000 mt WoW.

- Weekly alumina inventory: As of Thursday, SMM estimated that the total alumina raw material inventory of domestic aluminum smelters was 2.627 million mt, down 44,000 mt WoW.

- Overseas alumina transactions: On March 26, 30,000 mt of alumina was traded overseas at $368/mt FOB Gladstone, Australia, for shipment in early May; on March 26, another 30,000 mt of alumina was traded in eastern Australia at $375/mt FOB Gladstone, Australia, for shipment in early May; on March 27, 20,000 mt of alumina was traded overseas at $413/mt FOB Brazil, for shipment in late April to early May.

- Weekly alumina production dynamics: According to SMM data, as of Thursday, the total metallurgical-grade alumina capacity in China was 105.02 million mt, with the total operating capacity at 87.3 million mt, and the national alumina operating rate decreased by 0.67 percentage points WoW to 83.13%.

- According to SMM, starting from March 26, a large alumina refinery in Shandong adjusted the purchase price of 32% ion-exchange membrane liquid caustic soda, reducing it by 30 yuan/mt from the base price of 840 yuan/mt; that is, the ex-factory price under the two-ticket system was 810 yuan/mt (converted to 100% concentration, approximately 2,531 yuan/mt).

Spot-futures price spread report: According to SMM data, on March 27, the SMM alumina index was at a premium of 71 yuan/mt against the latest transaction price of the most-traded contract at 11:30.

Warrant report: On March 27, the total registered alumina warrants decreased by 899 mt WoW to 282,900 mt, with the total registered alumina warrants in Shandong flat at 4,513 mt, the total registered alumina warrants in Henan down by 899 mt to 25,800 mt, the total registered alumina warrants in Guangxi flat at 49,800 mt, the total registered alumina warrants in Gansu flat at 22,500 mt, and the total registered alumina warrants in Xinjiang flat at 180,200 mt.

Overseas market: As of March 27, 2025, the FOB alumina price in Western Australia was $400/mt, the ocean freight rate was $21.40/mt, and the USD/CNY exchange rate selling price was around 7.28, which translates to a domestic mainstream port selling price of approximately 3,547 yuan/mt, 420 yuan/mt higher than the domestic alumina price, and the alumina import window remained closed. Based on the latest transaction price of FOB $368/mt in eastern Australia, the domestic mainstream port selling price was around 3,300 yuan/mt, less than 200 yuan/mt higher than the SMM alumina price index. If overseas alumina prices further decrease and the rate of decrease exceeds that of the domestic market, the alumina import window may gradually open. On the export side, based on the latest spot alumina transaction price in Shandong, the domestic alumina export cost was around $450/mt, higher than the overseas spot alumina price, and the export window remained closed.

Summary: This week, the alumina operating rate decreased again, with the national total operating capacity of metallurgical alumina falling to 87.3 million mt/year, and the weekly operating capacity down by 700,000 mt/year WoW, but the overall supply surplus in the alumina market has not yet reversed. According to SMM data, as of Thursday, the total operating capacity of domestic aluminum smelters was 43.88 million mt/year, translating to an alumina demand operating capacity of around 84.47 million mt/year, with theoretical demand increasing slightly but still below actual operations. Meanwhile, downstream aluminum smelters reported that alumina procurement was mainly based on long-term contract execution, and some smelters that had conducted winter stockpiling planned to actively reduce inventory. This week, SMM statistics showed that alumina raw material inventory at smelters decreased by 44,000 mt WoW. In the short term, alumina supply is expected to remain relatively loose, and alumina prices may continue to face downward pressure. Subsequent attention should be paid to changes in alumina operating capacity.

[The information provided is for reference only. This article does not constitute direct advice for investment research decisions. Clients should make decisions cautiously and not use this as a substitute for independent judgment. Any decisions made by clients are unrelated to SMM.]